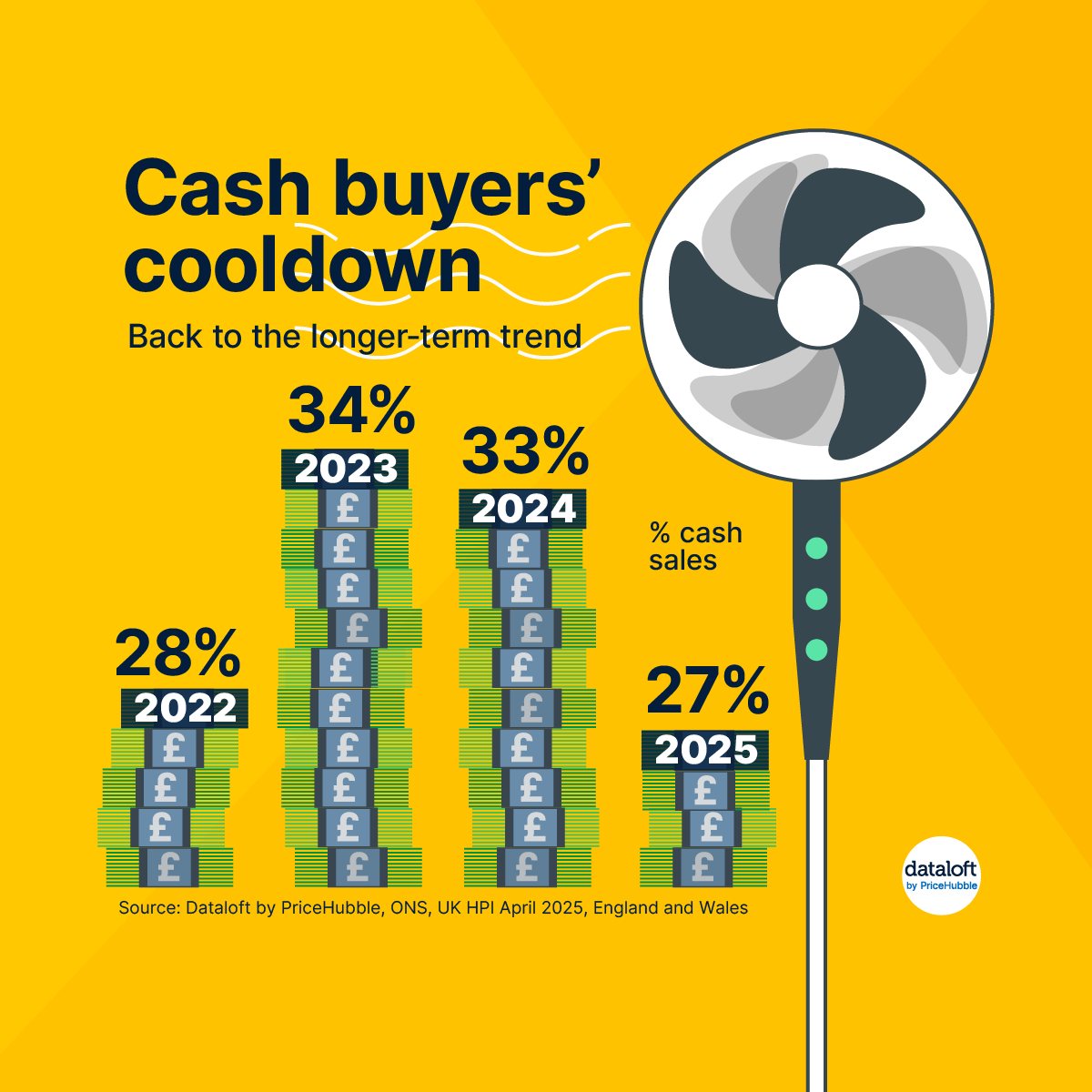

- According to Dataloft the share of cash buyers in Great Britain has declined, with 27% of sales currently cash-funded compared to 33% a year earlier.

- The South West still leads with the highest proportion of cash buyers at 33%, down from 40%, while London has the lowest at 18%, a drop from 25% last year.

- On average, cash buyers paid £19,385 less per property, equating to 7.2% less than those using mortgages.

- Following a short-term spike in cash purchases during 2023 and 2024, caused by high interest rates deterring mortgage buyers, the market is now reverting to its longer-term trend, as interest rates fall and mortgage demand rises.

Source: Dataloft