Letting Services

Our simple objective is to ensure that letting your property is trouble free and that landlords avoid the pitfalls.

Our services:

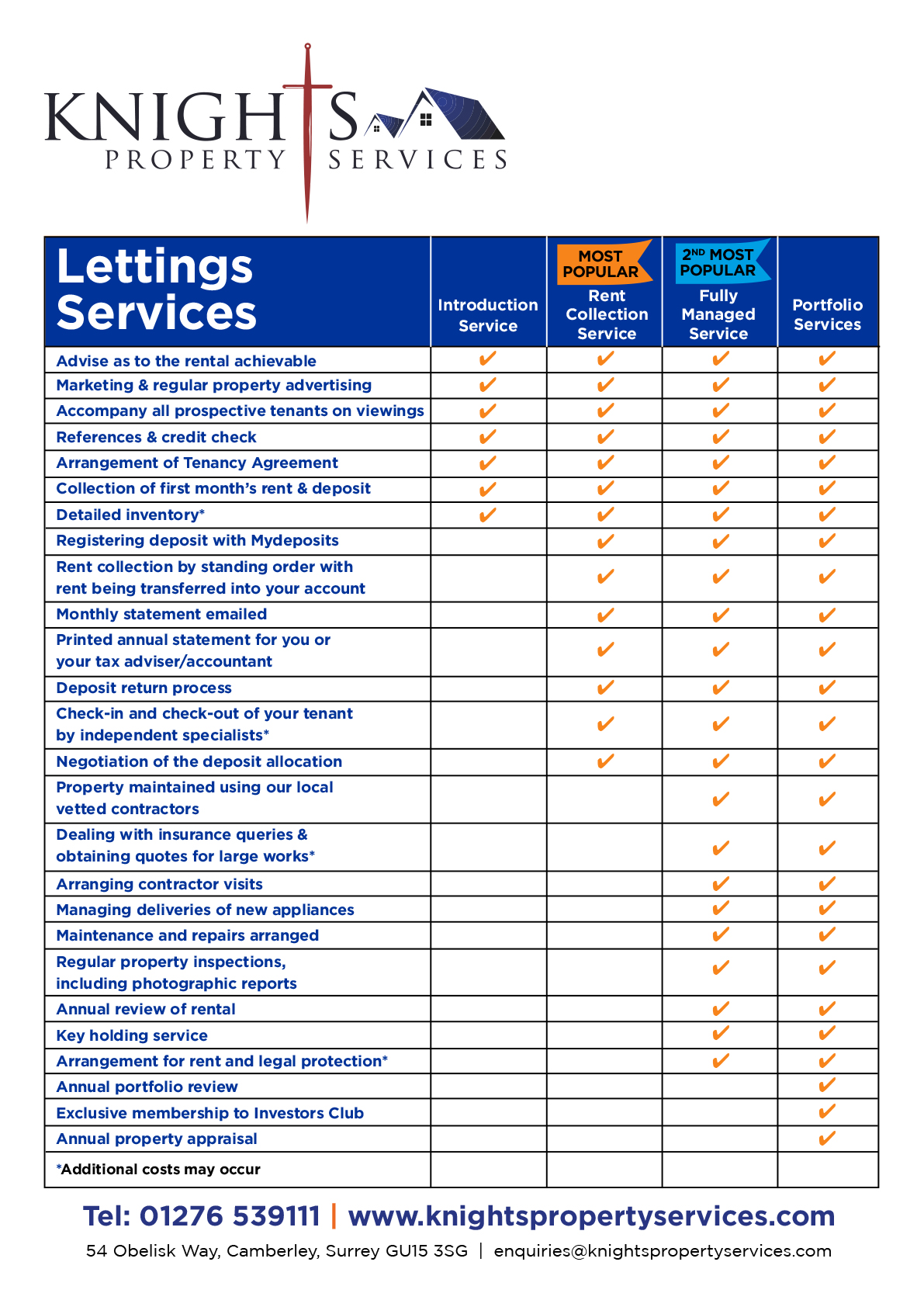

Fully Managed Service

This service will suit landlords who would prefer a third party to entirely deal with the letting and full management of their property and deal with all tenant queries and end of tenancy/deposit issues.

Rent Collection Service

This service will suit landlords who wish the tenancy to be set up correctly, rent collected and monitored on an ongoing basis but are happy to arrange their own maintenance, repairs and property visits.

Let Only Service

This service will suit landlords who wish for Knights to source a reliable tenant, complete all reference checks and arrange the tenancy agreement. Once the tenancy commences the landlord will be responsible for collecting the rent and managing the tenancy.